非会计师,非专业人士,仅供参考,后果自负!

去年eBay上卖了点东西超了600 USD被发1099-K了。。。

刚才报税,本来用Sprintax报的,发现没地方写1099-K,听别人说不用报,我也就没写了

这里应该是第二种做法,但是他没介绍如果你用的不是Turbotax怎么自己在税表上报这个税

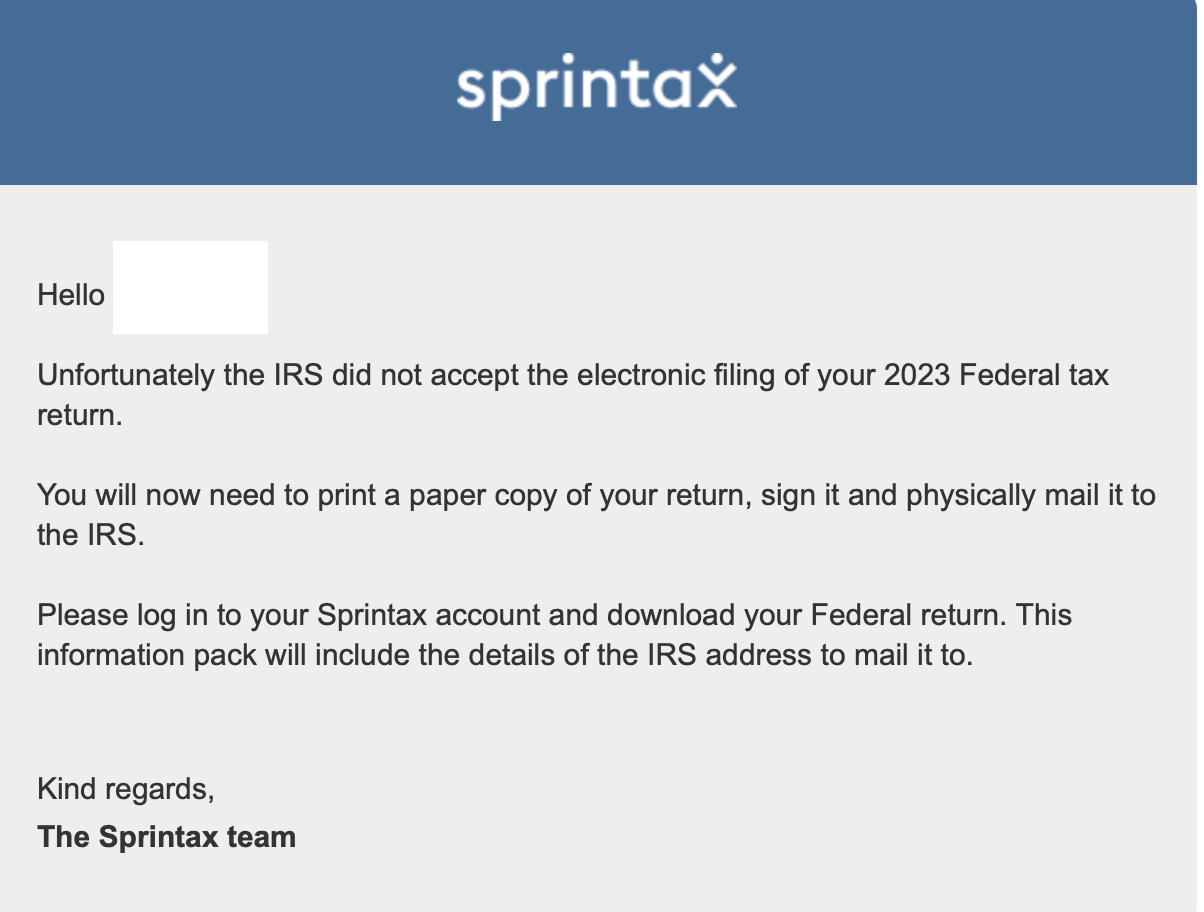

结果是e-file了之后直接给我拒了。。。。。。。。。

抱着反正也得邮寄的心理就认真看了遍,发现其实IRS还是希望你去报这笔收入的。。。。。。。。。。。

IRS官方教程:https://www.irs.gov/newsroom/form-1099-k-faqs-what-to-do-if-you-receive-a-form-1099-k https://www.irs.gov/businesses/what-to-do-with-form-1099-k

点开Q6

Report your proceeds (the Form 1099-K amount) on Part I – Line 8z – Other Income, using the description “Form 1099-K Personal Item Sold at a Loss.”

Report your costs, up to but not more than the proceeds amount (the Form 1099-K amount), on Part II – Line 24z – Other Adjustments, using the description “Form 1099-K Personal Item Sold at a Loss.”

In the example of the refrigerator sale above, if you received a Form 1099-K for $700 for the refrigerator for which you originally paid $1,000, you should report the loss transaction as follows:

Form 1040, Schedule 1, Part I – Line 8z, Other Income. List type and amount: “Form 1099-K Personal Item Sold at a Loss….$700” to show the proceeds from the sale reported on the Form 1099-K and, Form 1040, Schedule 1, Part II – Line 24z, Other Adjustments. List type and amount: “Form 1099-K Personal Item Sold at a Loss…. $700” to show the amount of the purchase price that offsets the reported proceeds. Do not report the $1,000 you paid for the refrigerator because the loss on the sale of a personal item is not deductible.

Personal items sold at a loss

A loss on the sale of a personal item can't be deducted from your taxes. But you can zero out the reported gross income so you don't pay taxes on it.

If you sold personal items at a loss, you have 2 options to report the loss:

Report on Schedule 1 (Form 1040)

You can report and then zero out the Form 1099-K gross payment amount on Schedule 1 (Form 1040), Additional Income and Adjustments to Income

Example: You receive a Form 1099-K that includes the sale of your car online for $21,000, which is less than you paid for it.

On Schedule 1 (Form 1040):

- Enter the Form 1099-K gross payment amount (Box 1a) on Part I – Line 8z – Other Income: "Form 1099-K Personal Item Sold at a Loss, $21,000"

- Offset the Form 1099-K gross payment amount (Box 1a) on Part II – Line 24z – Other Adjustments: "Form 1099-K Personal Item Sold at a Loss $21,000"

These 2 entries result in a $0 net effect on your adjusted gross income (AGI).

Report on Form 8949

You can also report the loss on Form 8949, Sales and Other Dispositions of Capital Assets, which carries to Schedule D, Capital Gains and Losses.

https://www.irs.gov/businesses/what-to-do-with-form-1099-k

也就是说,Income Effectively Connected With U.S. Trade or Business 这里8/9/10行是要填写的,如果是sold at a loss的话就全抵消掉最终为0,8=9=10(前提是你没别的收入需要填在这里的话),9是减去10的,11 adjust gross income就是0

写在Schedule 1(另外得去下这张表Schedule 1 (Form 1040), Additional Income and Adjustments to Income,1040NR也能用)的介绍是Form 1099-K Personal Item Sold at a Loss,8z和24z,写完记着看一下那一行的提示

文章评论